We believe every dream

is just a target away

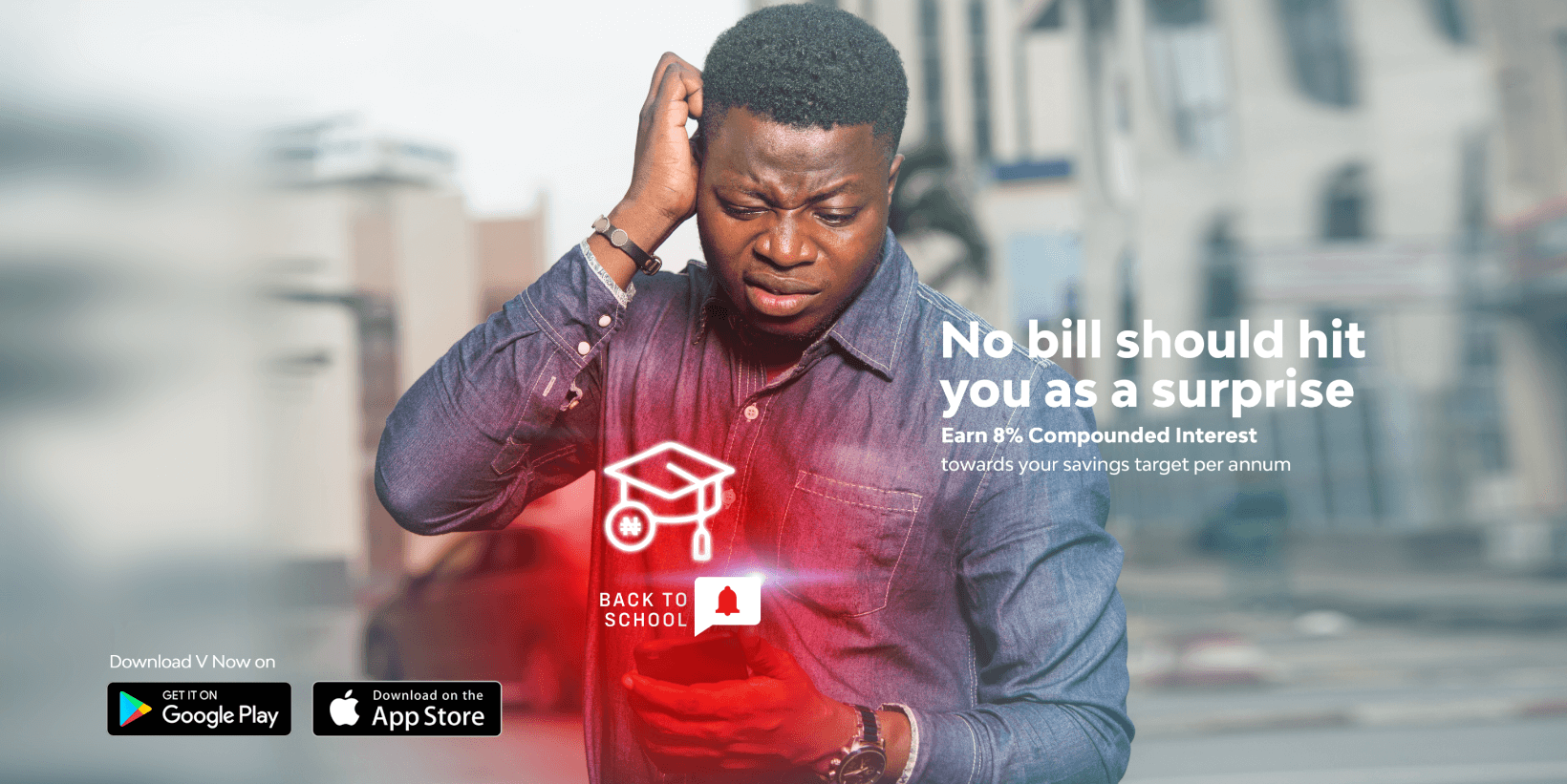

Our VFD Microfinance Bank Target Savings is for dreamers with big ambitions.

With 9% compounded interest per annum, the question for you is how far do you want to go?

With 9% compounded interest per annum, the question for you is how far do you want to go?

Because you are committed, we are committed

Open a Target Saving account, and we will match 20% of your first contribution towards the desired target amount.

Target Savings Calculator

[flier]

[flier]

[flier]

HOW TO CREATE A TARGET SAVINGS ACCOUNT

Frequently asked questions

20% of the first contribution is the bonus amount from VFD Microfinance Bank depending on the amount invested. E.g if you decide to make a monthly contribution of N10,000 VFD Microfinance Bank will give you a bonus of N2,000 in the 1st month. Please note that the 8% interest is applicable on the addition of both the bonus and the amount invested.

Yes, parents should open their children’s accounts on VFD Microfinance Bank

The parent will create the new target savings account under their existing universal account in the form prescribed CDTS /Child’s name/Child’s Age. For example: CDTS / Wale /5years. The monthly installments will also be debited from this account.

You can contribute any amount to the target saving, however, to earn the Children’s Day Target Savings Bonus at maturity, your monthly installments must be equal or more than your first month contribution.

No, you cannot. To qualify for the CDTS bonus, a monthly deposit of the initial start-up amount must be made. If the monthly contribution of same amount is not received, the CDTS bonus will be reversed and the balance will continue earning interest at 8% p.a compounded monthly.

Yes, the account creation process is available on the app. All you need to do is:

- Click the “More” button at the bottom of the screen

- Click “Open Target/Fixed Deposit Account”

- Select the Target Savings Account option

- Set a monthly contribution.

- Target Description should be: CDTS /Child’s name /Child’s Age

You can create the Children’s Day Target Savings Account for children between 0-18 years of age.

The bonus will be credited within 24 hours of creating your CDTS

Please log on to the VFD Microfinance Bank app and send a short mail via the “contact us” button.

The CDTS Bonus will apply to deposits that start on or before 31st May 2020

The 20% bonus is a flat bonus. Your child gets 20% of the initial/first month contribution within 48 hours of setting up the CDTS account. Additionally, an interest rate of 8% per annum accrues monthly and is compounded monthly on the entire balance.

If you break your Children’s Day Target Savings Account before 6 months, you lose all the contribution from VFD Microfinance Bank, also target saving has a minimum of 6 months tenor, so early liquidation will also lead to a surcharge on accrued interest. However, if you break the Children’s Day Target Savings Account after 6 months, you lose only 50% of the contribution from V but the 8% interest will still stand

NB: Only complying deposits for the full period will enjoy full benefits.

The 8% interest rate on the Children’s Day Target Savings Account is applicable to the first contribution in addition to the CDTS Bonus.

No, there is no need to provide the child’s birth certificate to liquidate or to book your Children’s Day Target Savings Account. Ensure the target description has CDTS/Child’s name/Child Age for easy tracking.

You can create a CDTS account for as many children as you want.

If you skip a payment before 6 months, then you lose the bonus from V but if you skip a payment after 6 months you only lose 50% of the bonus from VFD Microfinance Bank. This does not affect your accrued interest as long as there is no liquidation and pay out from your target saving account.

Once set up, your target saving will be funded from your selected primary universal savings account or your individual current account. Your target savings also generates a unique account number and you can fund this account directly from any bank. To fund from other banks, the account name will also be the name of the primary account holder. You can set up direct debits from other banks to this account.

Yes, the 20% bonus from VFD Microfinance Bank also accrues the 8% interest rate

The account profile will be counted as one. However, the total balances will be counted towards your balance target requirement. This also helps you ensure all your accounts are active and remain active.

Log into your app, click on “contact us” us and leave us a message quoting the account number of the target saving you want to liquidate and the account you want credited.